At the end of 2023, the average renewal premium in the automobile portfolio stands at €366,51 (+3,25%), while for new production it amounts to €354,97, 6,93% more.

El ebroker Data Analytics team has published a new report in the PRISMA observatory comparing the evolution of insurance prices at the end of 2023 compared to the previous year.

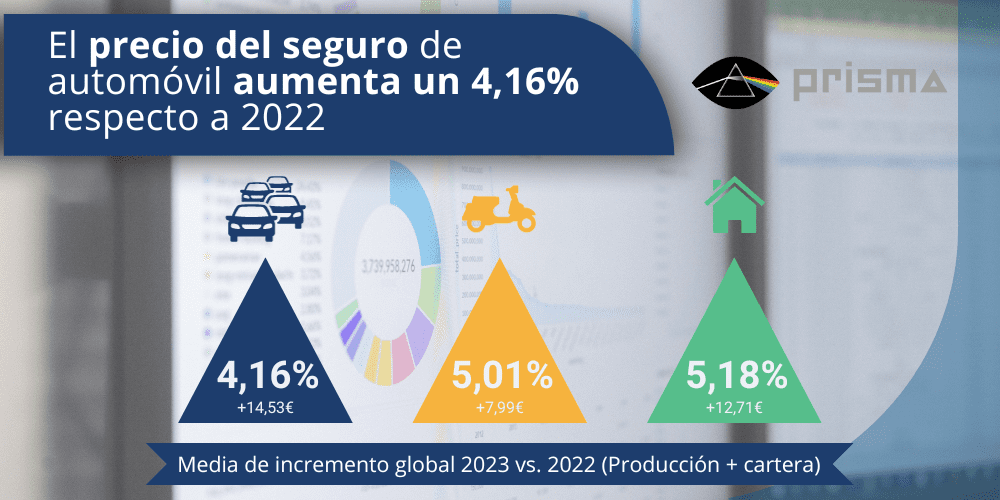

By class, in 1st category cars, the average insurance price (new production + portfolio) has experienced an increase of 4,16%, €14,53 more compared to 2022. Regarding the portfolio renewal, the average price amounts to €366,51 (+3,25% vs. 2022) while, for the new production, even registering the lowest insurance price (€354,97), is, with an increase of 6,93%, the largest % increase (€23 more).

In the field of Motorcycles el half price of insurance in runners channel in 2023 it will reach 167,41€, which is a increase of 5,01% with respect to the previous year. If we look at the new production, the insurance premium increases by 8,03%, while the rise for the portfolio renewal is from 4,39%, both premiums being around the $167.

For the branch of Home There is also observed a general increase. On this occasion, the half price of insurance is located in the 257,94€, which is a del% increase 5,18 compared to 2022. In new production, the price of insurance reaches 239,54€ a 5,68% rise. In portfolio renewal, the price to pay for home insurance increases 5,04%, this being for the closing of the year of 261,73€.

Overall, average insurance prices have seen a progressive increase throughout 2023 in all the branches analyzed, being in the portfolio, insurance Home those that have increased the most, 5,04%, followed by the bouquet of Motorcycles y Automobiles with an increase in the average price for the renewal in the portfolio of the 4,39% and 3,25%respectively.

This data study has been carried out on a sample of just over 2,3 million policies, of which both new production operations and portfolio renewal operations in the Automobile, Motorcycle and Home branches have been taken into consideration.

Share