Higinio Iglesias

CEO of ebroker

Higinio Iglesias talks about Big Data and its application in the insurance sector. Published in January 2024 by Digital World.

How do you handle data collection in the insurance sector and what are the specific difficulties when integrating large volumes of information?

As a sign of our commitment and vision with the role that technology would play in insurance mediation companies, in 2000, E2K invested in the creation of the ebroker technological platform, a technological environment specifically designed for insurance brokers, which It allows them to manage their business operations, their information system, and also offers them connectivity for the exchange of data with the main insurers in the market for which they carry out mediation activity.

With ebroker, brokers manage their information systems, and through its functional Data Analytics components they transform information into knowledge, obtaining a vision of both their individual reality as a company, and a comparative vision with certain market indicators. All this through the exploitation of diverse data sources, advanced technology for data consolidation, structuring of information, scalability of available resources, the application of AI in different areas, an important environment of automated processes, with a rigorous data quality policy, and strict regulatory compliance subject to standardization and certification of information security under ISO27001 standards.

How do you address the ethical challenges associated with data collection and use in the insurance sector, especially in relation to customer privacy?

We recognize the importance of protecting the privacy and security of information through ethical measures and practices, to ensure responsible data processing, subject to criteria-based procedures and audits, such as ISO27001 standardization and GDPR regulation. We address ethical challenges related to data collection and use in the insurance sector through transparent and secure practices. We are committed to protecting the privacy and rights of our brokers and clients while harnessing the potential of data to improve our services and operations.

What benefits could your partnership experience from implementing Big Data solutions in terms of operational efficiency, risk reduction, and improved customer experience?

The implementation of Big Data solutions in business cooperation environments, through platforms such as ebroker, offers a series of significant benefits in terms of operational efficiency, risk reduction and improvement in customer experience. In the area of operational efficiency, automation and data analysis allow for more efficient management of the business operations of our community of brokers. Optimizes internal processes, identifies areas for improvement and facilitates informed decision making to increase productivity. It also contributes to risk reduction. Real-time data analysis allows you to proactively identify and manage risks. It is possible to detect behavioral patterns that indicate possible problems and take preventive measures to mitigate risks before they become crises. For example, predicting the risk of a customer fleeing or non-payment of insurance premiums.

We must adopt solutions that allow us to obtain constantly updated information to support operational and strategic decision making.

What is the strategic importance you give to training and updating staff in relation to the management of Big Data tools and concepts?

The insurance sector is undergoing significant changes. The digital era, with its proliferation of data and technologies, has led to a profound transformation, reconfiguring the role of brokerages and the skills they demand from new professional profiles. We give significant strategic importance to the training and updating of personnel in relation to the management of technological tools and concepts, especially with regard to the exploitation of data and the use of multiple productivity tools.

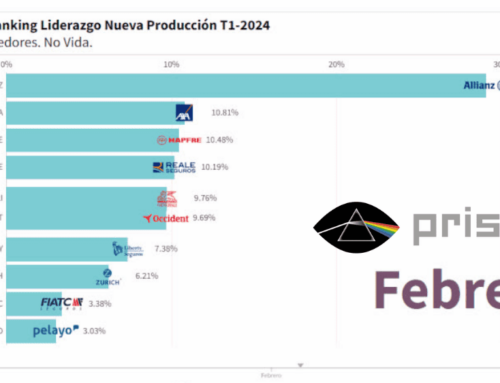

In 2022, E2K and ebroker promote and sponsor the University of Oviedo's own title of University Specialist in Data Science Applied to Insurance Activity, a pioneering initiative related to specific and essential professional training for the sector, in which we have the support of large insurers in the Spanish market such as Mapfre, Axa España and Grupo Catalana Occidente. Training is essential to stay updated, competitive and harness the potential of data for the benefit of our brokers. We are committed to providing continuing professional development opportunities to our staff in this field.

What are the most relevant trends in the field of Big Data that E2K must take into account to remain competitive?

In general terms and at the level of trends, being competitive in the field of services based on Big Data requires paying special attention and adapting proactively in different areas. Analytics in real time. The ability to analyze data in real time is essential for making agile, data-driven decisions. We must adopt solutions that allow us to obtain constantly updated information to support operational and strategic decision making. Data privacy and security. Increased data collection brings greater challenges to data privacy and security. We must ensure that we comply with data protection regulations and ensure the security of confidential information. User experience is essential. We must use data to better understand the needs and preferences of our insurance broker customers and offer solutions that improve their experience and satisfaction.

Collaborating with other organizations and creating shared data ecosystems can enrich the availability and access to relevant information. We should explore strategic alliances that allow us to access additional data, improve the outcome and diversity of services based on it. And finally, ethics and responsibility in the use of data is a critical issue. We must establish policies and practices that guarantee responsible and ethical use of the information managed by Big Data systems.

How do you evaluate the return on investment (ROI) of your Big Data or data measurement initiatives in terms of business growth and improved operational efficiency?

Our approach is to measure ROI from a comprehensive perspective that encompasses both business growth and improved operational efficiency. This allows us to evaluate the overall impact of Big Data initiatives on our company and on the satisfaction of our broker community.

Share