BI brings high-value processes to the broker, such as segmentation, which allows it to automatically and intelligently classify its customers.

Currently a brokerage handles a huge amount of data about your business and your customers. It can be very relevant data but without value if they are not ordered and analyzed in an appropriate way.

To think that a broker can have the time and resources to put in value the data that it handles in all the slopes that could apply them, is not realistic.

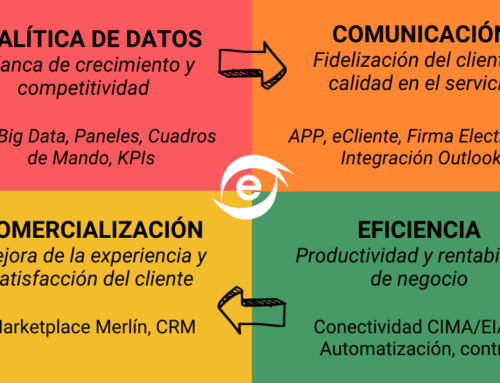

Faced with this situation, the broker can not remain on the sidelines and must equip himself with the tools of Business Intelligence (BI) that, combining the data that manages in its management program (ERP), allows you to monitor the critical aspects of the brokerage, analyzing the administrative, financial or commercial facets in real time and helping you in making business decisions.

Each variable of our business can be measured by means of an indicator, and the BI tools must be grouped in a library available to the broker. From them we can obtain information such as: real value, objective compliance, market value ...

Some examples of basic indicators are: how much income is contributed, how many contracts-insurance policies come from that income, what is the seniority in the portfolio of those contracts or what is the cost for the management burden of that client.

Other indicators inform us about the financial or commercial aspects of the brokerage such as: Collection period, Financial / personal expenses, Working capital, Liquidity ratio, Debt ratio or campaigns, business opportunities, commissions ...

The indicators (KPIs) allow analyzing all information about customers, policies, receipts, claims, economic and financial data, business management ... and provide a general view of the business through dashboards and graphic panels that contextualize, group by area and monitor the objectives of the brokerage.

The broker has a clear vision, in real time and accessible from any mobile device of the strategic information of his business.

The BI also provides high-value processes to the broker, such as segmentation, which allows it to automatically and intelligently classify its customers. Based on the combination of several indicators, you can create a ranking that the clients order according to the chosen criteria.

Intelligent customer segmentation allows you to customize campaigns, provide individual attention and optimize the commercial and marketing resources of the brokerage.

The implementation of Business Intelligence opens up a scenario of improvements in the management of the brokerage and in the relationships of the broker with its customers. The broker has, with the BI integrated in his management program, a tool that makes him feel, in first person, that information is power or, at least, that having information is being able to make decisions in a more conscious and aligned with our business objectives.

Commercial, Marketing and Communication Area